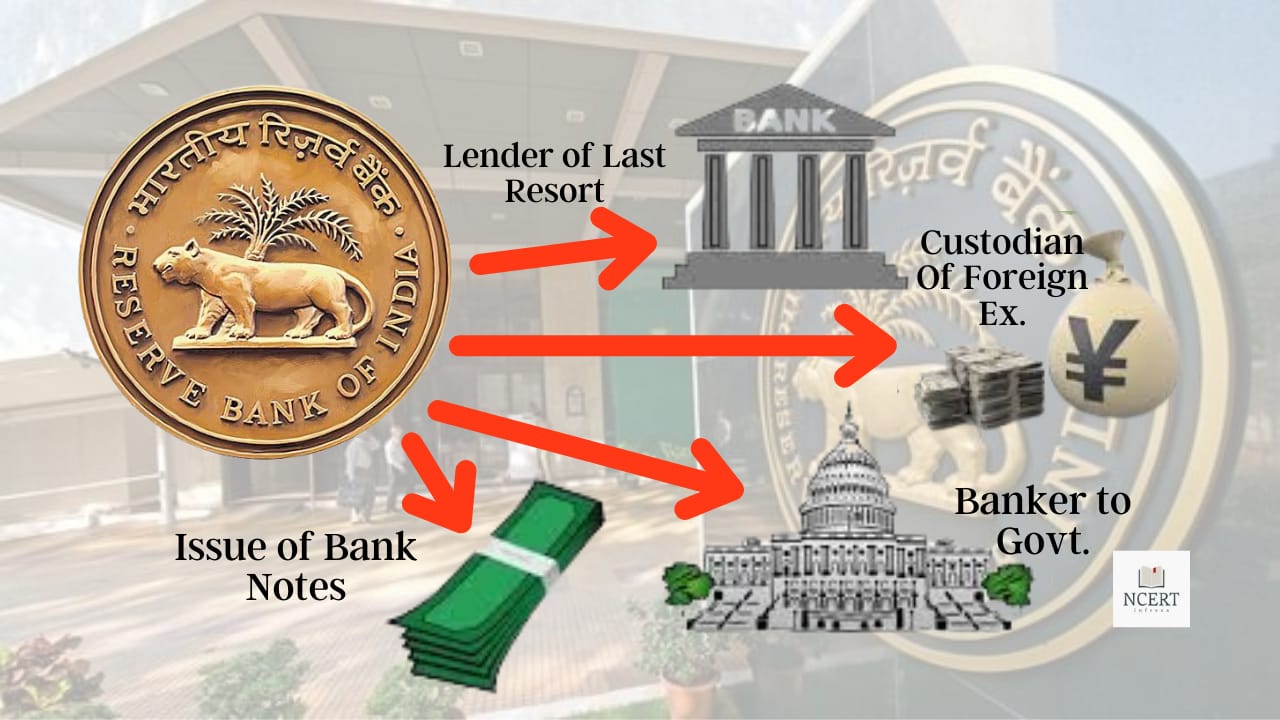

Question – What are the major functions of the Reserve Bank of India (RBI)?

Answer – The Reserve Bank (RBI) was established on 1 April 1935 as the central bank of the country. In the beginning, the Reserve Bank was a body of shareholders.

Its authorized capital was Rs 5 crore, divided into 55 lakh shares of Rs 100 each. The Reserve Bank (RBI) was nationalized in January 1949.

The management of the Reserve Bank is in the hands of the Central Board of Directors consisting of 20 members. The headquarters of the bank is located in Bombay.

Functions of Reserve Bank (RBI)

The functions of the Reserve Bank (RBI) can be divided into two parts.

- Central Banking Functions and

- General Banking Functions.

1. Central Banking Functions

Being the central bank of the country, the Reserve Bank of India (RBI) has to do all the work of central or banking. This work is as follows:

(a) Issue of Notes

The Reserve Bank has the monopoly of note issuance. Till 1956, the Reserve Bank (RBI) issued notes based on the proportionate fund method.

In October 1956, the minimum method of note withdrawal was adopted, under which the minimum quantity of gold fund was fixed at Rs 115 crore and the minimum quantity of foreign securities was fixed at Rs 85 crore.

(b) Credit control

The legal basis of credit control in India is determined by the Reserve Bank of India Act of 1934 and the Indian Banking Companies Act of 1949.

Under the RBI Act, of 1949 the Reserve Bank has got power to change the bank rate, open market operations and change the convertible fund ratio. Under the Indian Banking Companies Act of 1949, the Reserve Bank has got the powers of selective credit control.

(c) Government Banker and Economic Adviser

As a Government Banker, the Reserve Bank (RBI) protects the funds of the Central and State Governments.

It maintains accounts of various government funds accepts payment of taxes from the public in the name of the government and pays checks issued by the government.

(d) Exchange-control

The exchange-control department of the Reserve Bank (RBI) keeps an account of the demand and supply of foreign exchange and tries to maintain balance in them.

(e) Bank of the Bank

As a bank of banks, the Reserve Bank (RBI) performs all these functions towards the member banks, which a bank does towards its customers.

(e) Clearing-House

As a clearinghouse, the Reserve Bank facilitates the remittance of funds among member banks.

(f) Regulation of the Banking System

The RBI has wide powers under the Banking Regulation Act of 1949 to control the banking system of the country, such as licensing of banks, keeping control of branch expansion by banks, and scheme of consolidation of banks.

Investigating and giving approval, giving necessary advice and instructions to banks after examining the loan policy, etc.

Under section 35 (A) of the Banking Regulation Act, 1949 a new scheme “Ombudsman Scheme 2006” was launched to empower the RBI (Reserve Bank of India) to set up a forum for bank customers to resolve complaints relating to certain services rendered by banks. The Ombudsman scheme aims to accept the direct complaints of the customers aggrieved by the bank or its any service.

(g) Collection and publication of economic information

The investigation and data department, of the bank, conducts research in relation to various economic subjects like money credit, agricultural production, money market etc. and collects and publishes data related to it.

Read this also: SSC: Structure, major functions and exams offered by it

2. Ordinary / General Banking Functions

Along with the central banking functions, the Reserve Bank (RBI) also performs some general banking functions, which are as follows.

(a) Acceptance of deposits

The Reserve Bank can accept deposits from the Central and State Governments, commercial banks, government or semi-government institutions, and individuals. But it cannot pay any interest on the money deposited with it.

(b) Buying and selling of trading papers

The Reserve Bank may buy-sell and re-deduct such trading papers or promissory notes, the duration of which does not exceed 90 days, which are to be paid in India and on which at least two have a dignified signature.

(c) Grant of loan

The Reserve Bank can provide ways and means to advance to the Central and State Governments for 90 days against the security of approved securities, gold, and silver promissory notes, etc.

(d) To take a loan

The Reserve Bank can obtain a loan from any foreign central bank or scheduled bank of India on the public opinion of its assets for a period of 30 days, the amount of which should not exceed the total capital of the bank.

(e) Opening of accounts in foreign central banks

The Reserve Bank (RBI) can open its accounts in foreign central banks. Can appoint agent banks abroad and transact with international financial institutions.

Related: Capitalism: Meaning and its impact on society